The Australian Government has backed down on it’s controversial backpacker tax changing the rate to 19%. What do you think about the back down?

The government has also increased the passenger levy for backpackers, you will be slugged $5 extra when you leave the country.

WHV Age has been increased to 35 and the working holiday visa fee has been dropped by $50.

The tax will still have to get through the senate and it remains to be seen if Labour will support the tax, if not they may face trouble getting through.

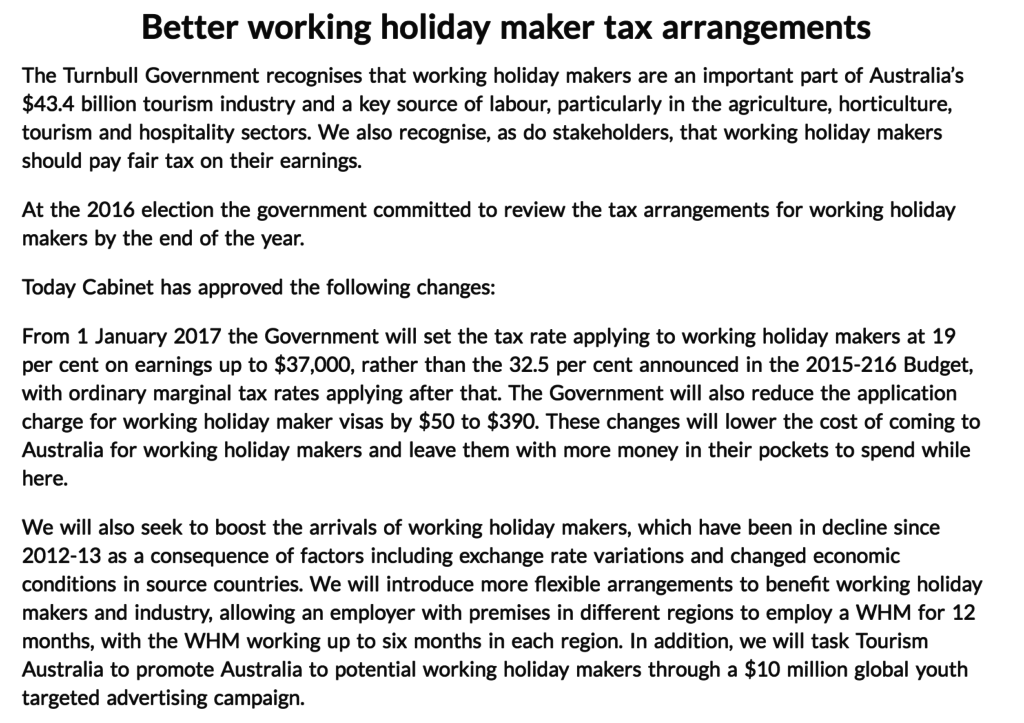

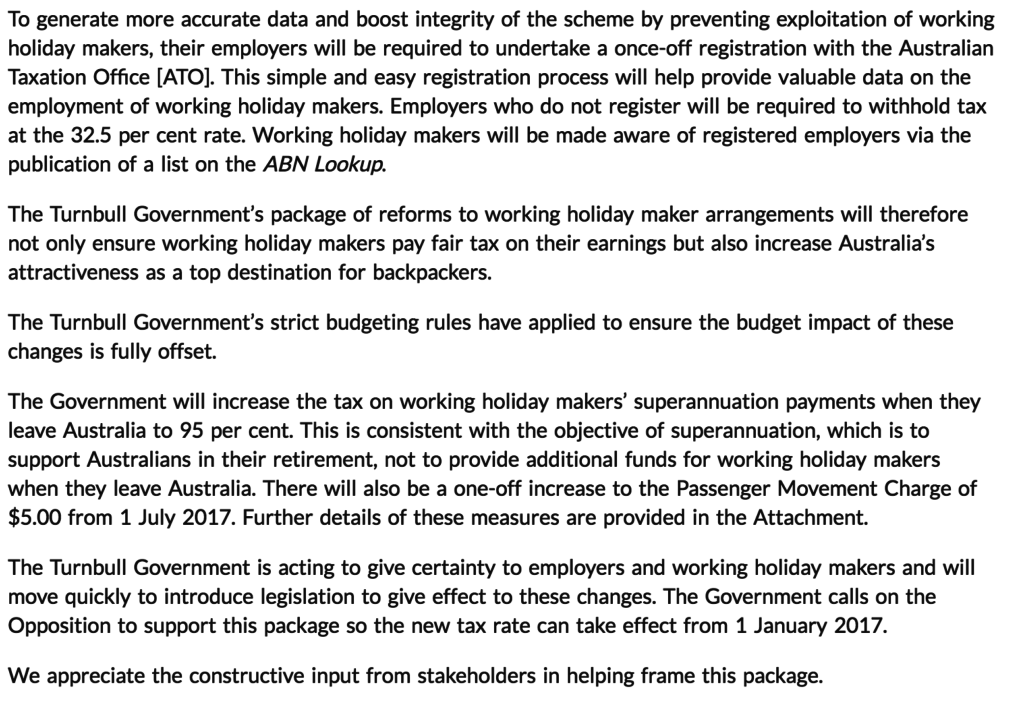

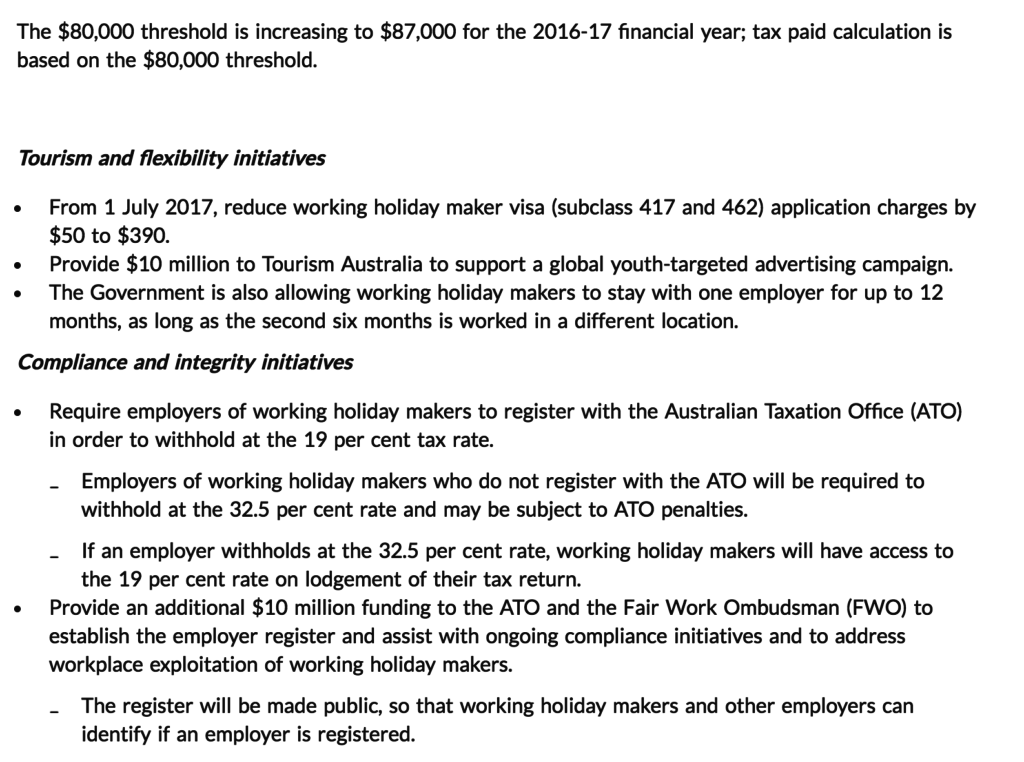

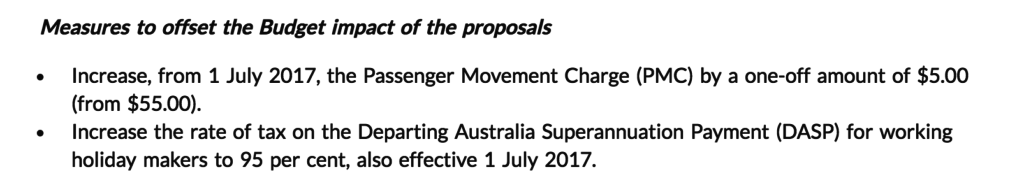

Summary of the backpacker tax proposal

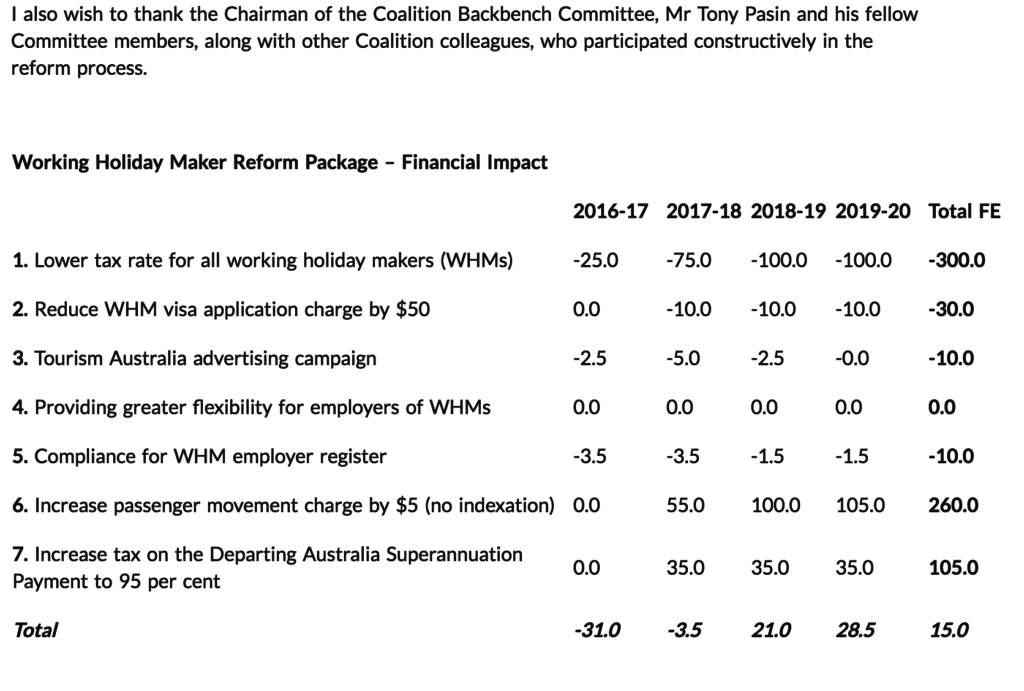

-19% tax from dollar 1( previously 32.5%)

-95% of super taxed ( previously 65%)

-Age limit increased to 18-35 ( previously 18-30)

-Working Holiday Visa Fee dropped by $50

– Exit Levy increased by $5

Government Official Statement

Below is the official statement from the treasurer Scott Morrison.

In The Media

Treasurer's pressa called for 12.30. It's been a long 16 months, #backpackertax tweeps, but the end is nigh. Stay tuned. #auspol #agchatoz

— Anna Vidot (@AnnaVidot) September 27, 2016

Win on backpacker tax, cut from proposed 32.5% to 19% – a win for farmers, can get fruit off the tree and off to market. #auspol #agchatoz pic.twitter.com/xX2nmF5xpg

— Barnaby Joyce (@Barnaby_Joyce) September 27, 2016

On the edge of my seat waiting for official announcement of #backpackertax compromise @GoodFruitandVeg @grow_dem_melons

— Rachel Mackenzie (@GrowcomRachel) September 27, 2016

2 Responses to “Backpacker Tax Proposal Updated”

Frederika Steen

As a former Immigration Officer directly involved in negotiating Working Holiday Maker agreements in Europe, I think the now discounted (from 32.5c to 19c in the $ tax rate) on “back packers” is a poor compromise and not in the national interest. The Scheme was designed to target young adults and to be reciprocal with selected countries. It allows tens of thousands of young people their “freedom year “ of exploration and maturation after secondary or tertiary education. It was not intended as a cost effective revenue raising labour program to plug the gaps left in seasonal harvesting work and casual work by Australians. Most backpackers travel , have fun, work and spend it all here.

Carefully managed, the WHM Scheme builds personal relationships around the world and an understanding of and love for our multicultural way of life. That is absolutely priceless. The widget counters and policy makers in Government should find other ways to fill seasonal labour shortages among the Australian born unemployed. And why not grant refugees forced to be idle for the last three years the right to work, and support them with an enabling relocation grant, and monitor their accommodation and fair wages and conditions wherever the work is ? Just don’t exploit them and add to the damage already done to them.

Jess

I think this is a rubbish idea! with regards to the tax change! WHM’s will end up paying more tax without the 18,000 tax free threshold! If a WHM is a resident for tax purposes, would they still have to pay the new tax or would they carry on with what is currently in place?